No Bull | The Five Spot

5 | Cleared for takeoff

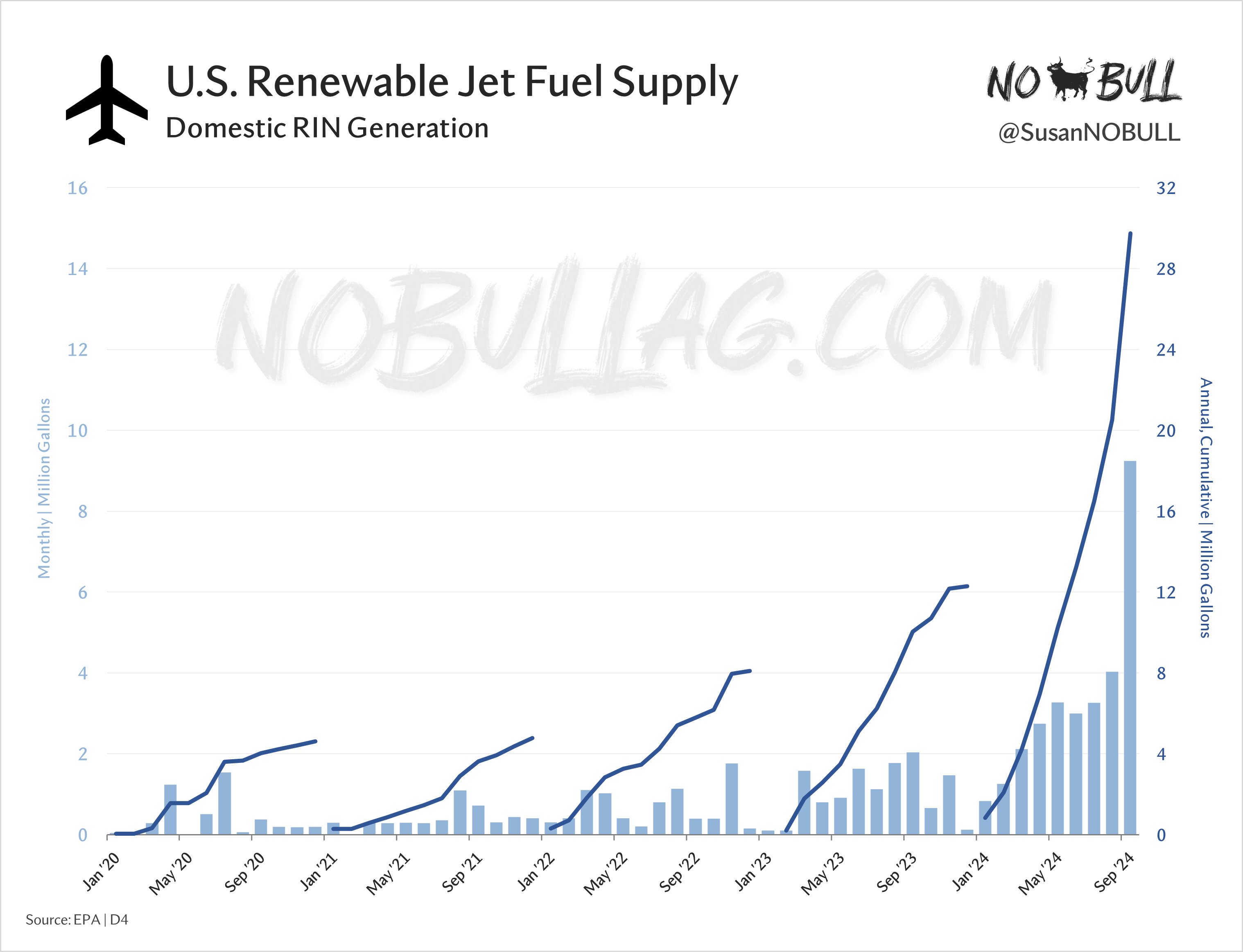

U.S. sustainable aviation fuel production is taking off, literally.

Domestic renewable jet fuel RIN generation was a record 9.2 million gallons in September, more than two times larger than August’s four-million-gallon record and up 353% year-on-year.

In the first nine months of 2024, the U.S. has cranked out more renewable jet fuel than in the four previous years COMBINED.

4 | Taking off 2.0

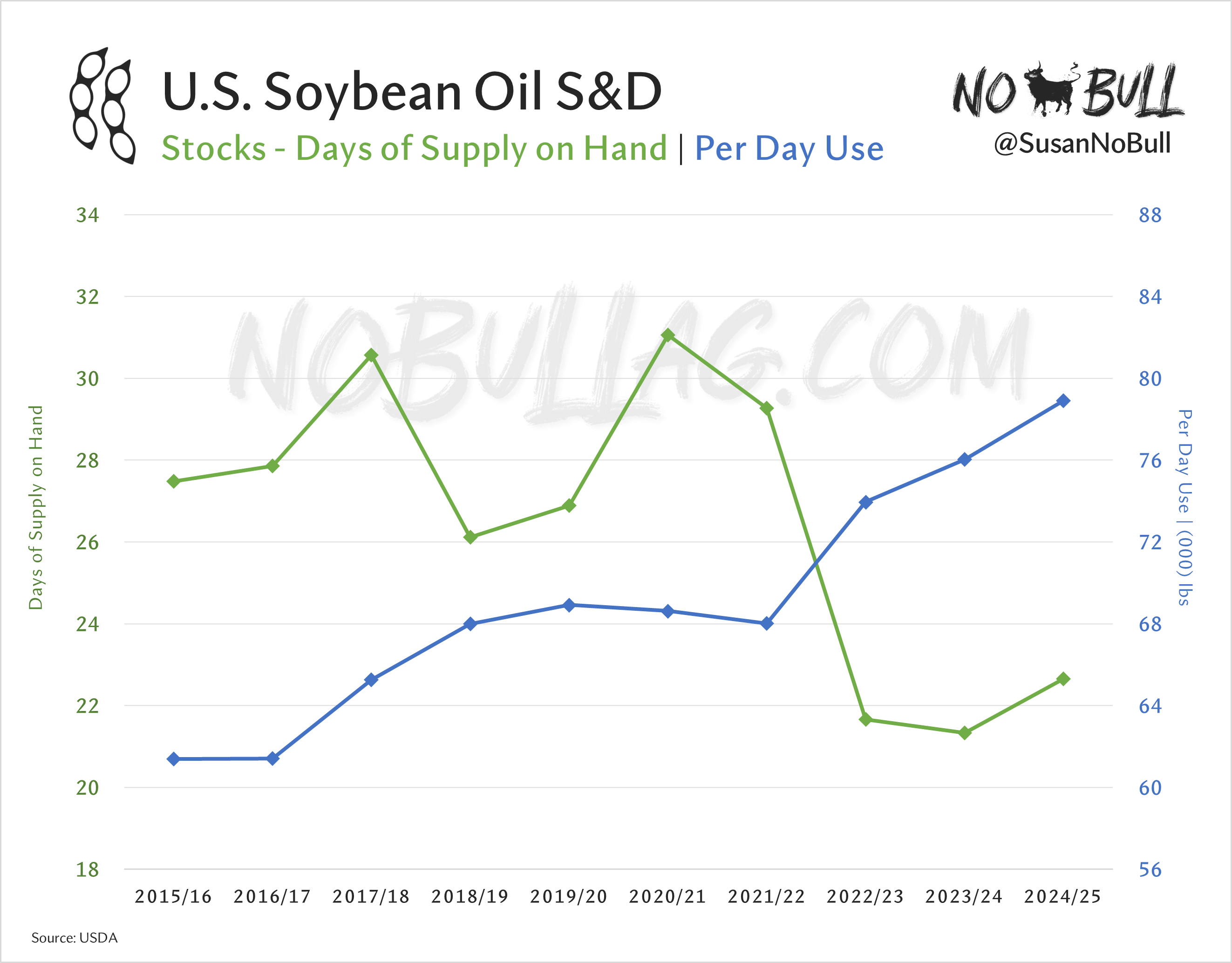

SAF production is not the only thing taking off in the U.S. as soybean oil demand is set to hit a record high for the third consecutive year in 2024/25.

This surge is driven by continued growth in biofuel use and a rebound in exports, fueled by rising global vegetable oil prices.

Despite record production for the 11th year in a row, the U.S. has struggled to build stocks as strong biofuel demand has outpaced production growth, even amid crushing capacity expansion.

3 | The U.S. is not on an island

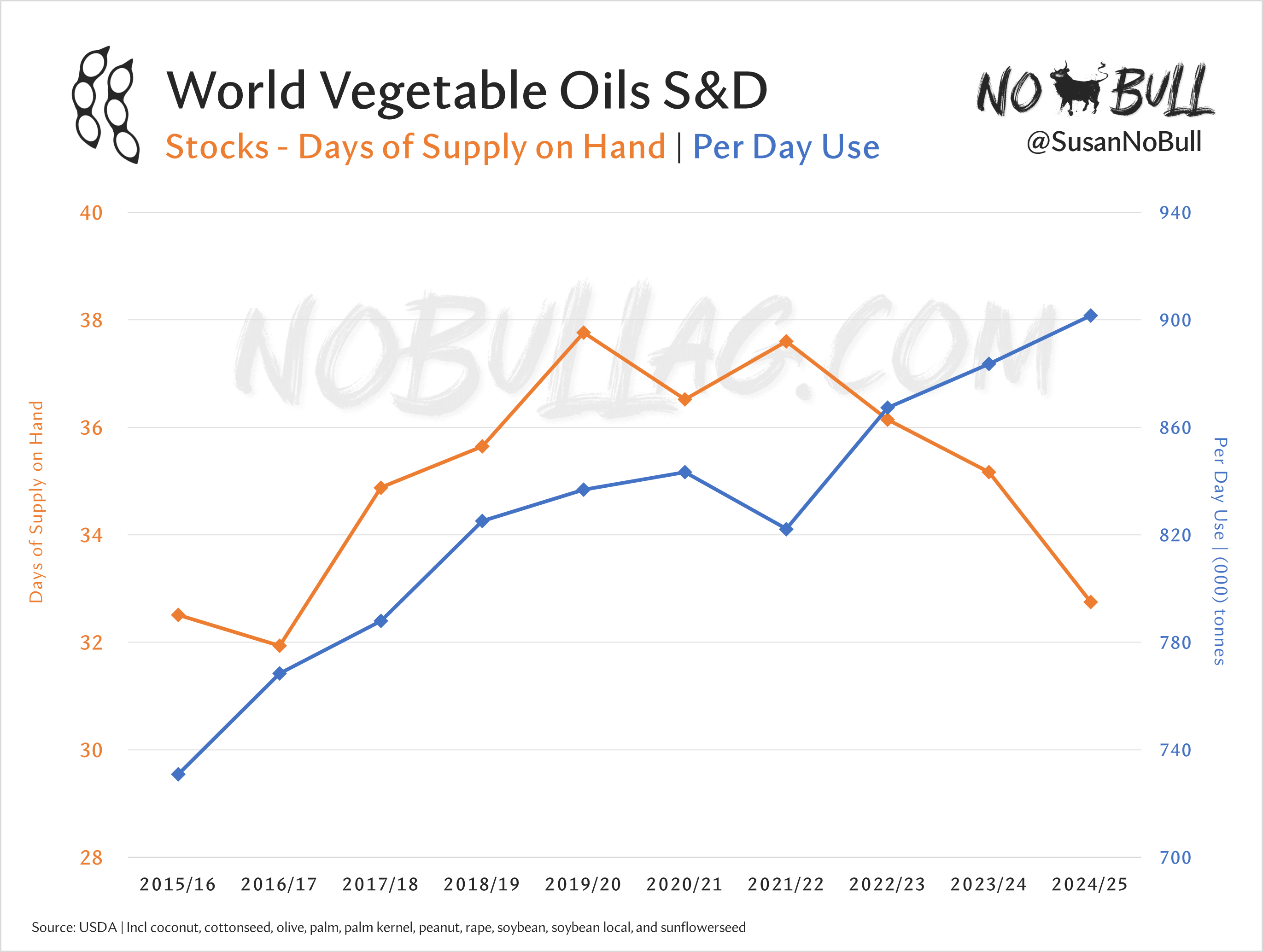

Likewise, global demand for vegetable oils is surging on growing biofuel initiatives worldwide.

This, coupled with Argentina's 2022/23 crop failure and a handful of other factors has tightened world stocks in terms of days of supply on hand to an 8-year low.

Two of the biggest drivers in the biofuel veg oil boom are the U.S. and Brazil who have seen a 150% and 100% increase, respectively, in biofuel demand for soybean oil over the past decade.

Big shifts in demand disrupt traditional trade flows and encourage substitutions among the larger pool of veg oils.

This has been particularly evident the past few years as supplies have grown increasingly tight and price relationships have grown increasingly distorted.

2 | A whopper

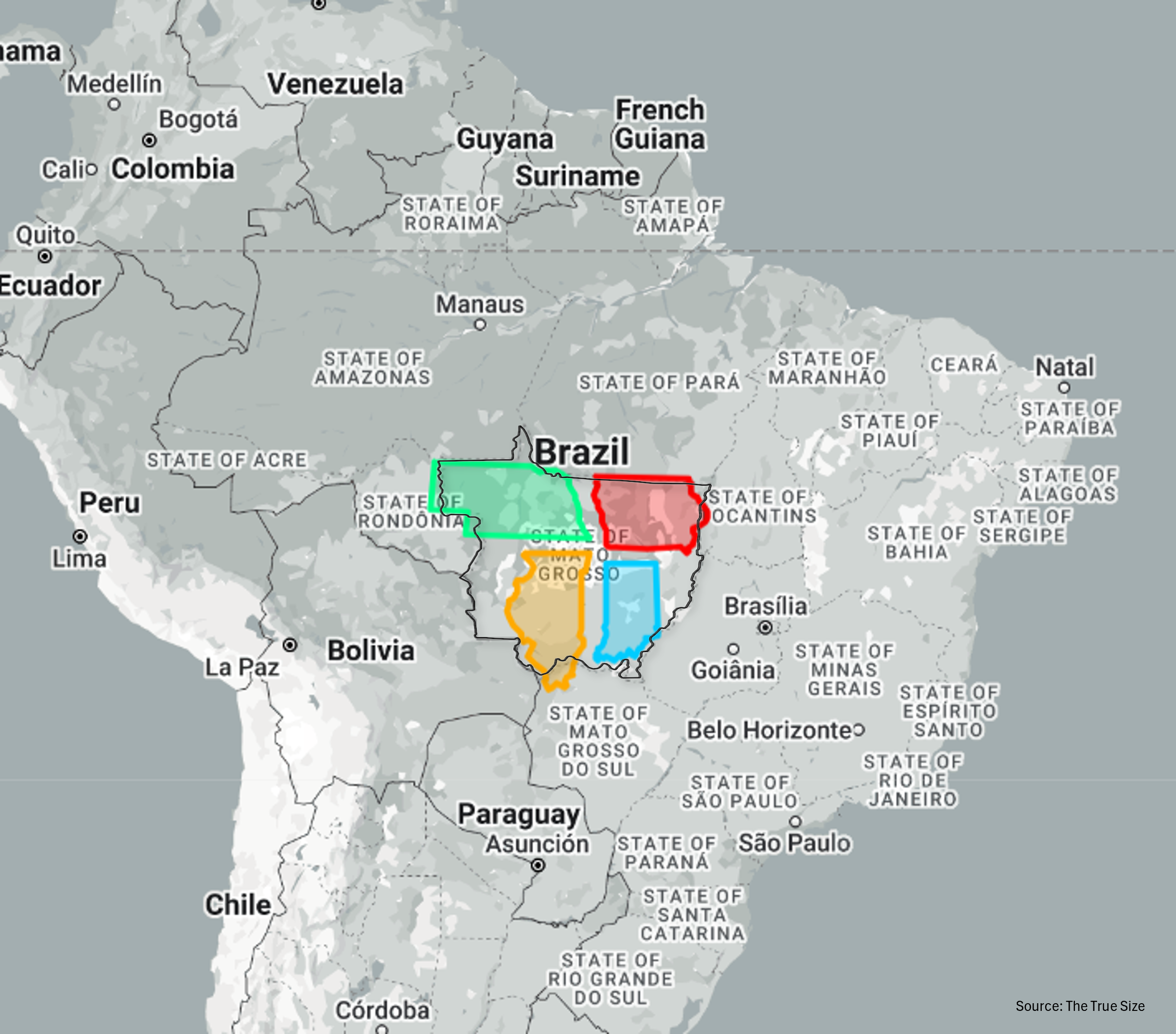

Mato Grosso is Brazil’s largest-producing state, expected to produce 1.7 billion bushels of soybeans and nearly 2 billion bushels of corn this upcoming season.

That is more bean production than Iowa, Illinois, & Indiana, combined and its Safrinha corn production is the equivalent of Nebraska’s entire corn crop… and it's ALL a double crop to boot.

Mato Grosso is YUGE. Nebraska, Iowa, Illinois, & Indiana could all fit within its borders and there would still be more than 100,000 square miles to spare!

1 | Tis the Season

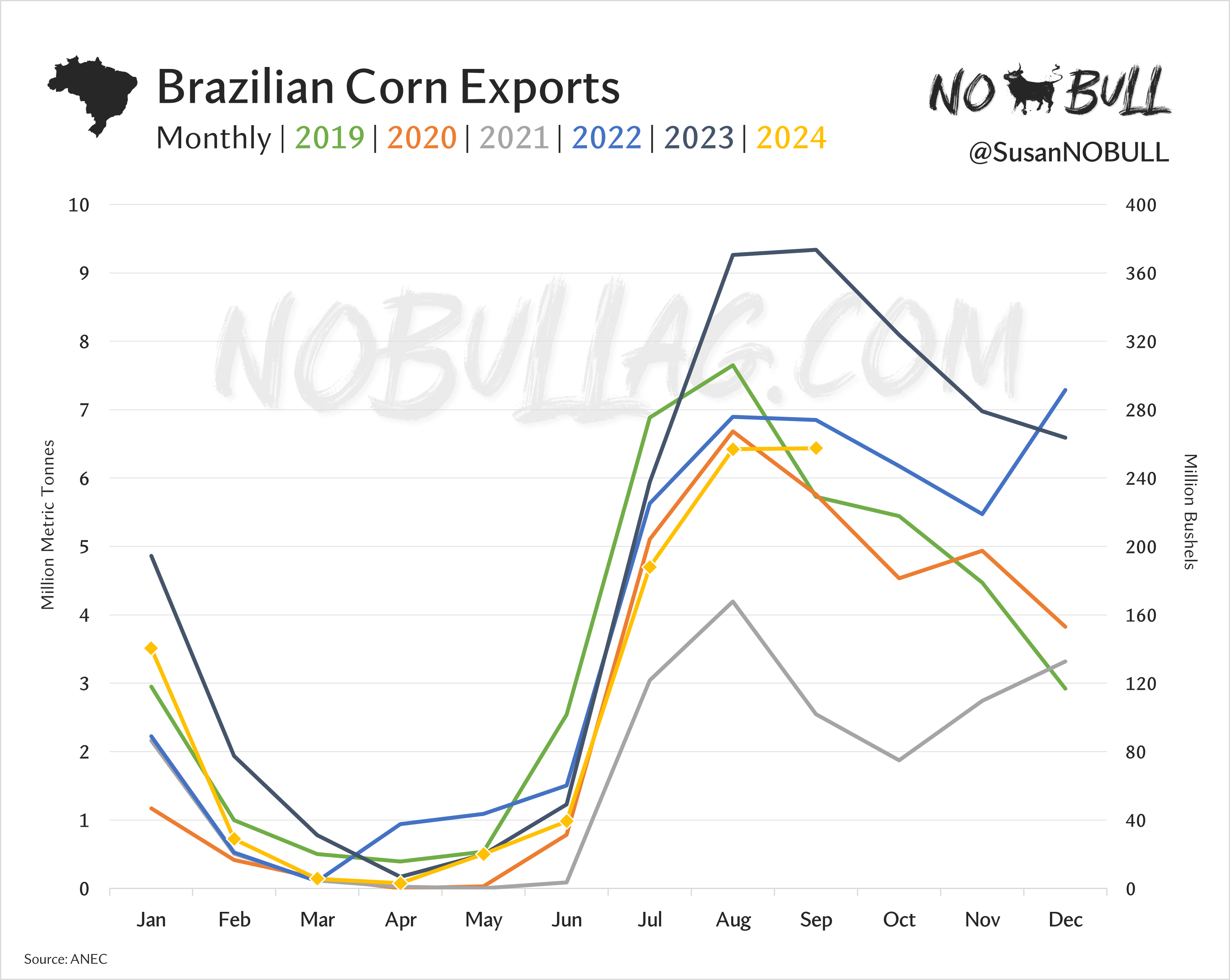

U.S. corn export interest has surged recently on lower Ukrainian production and reduced Brazilian export availability and resulting increase in export premiums.

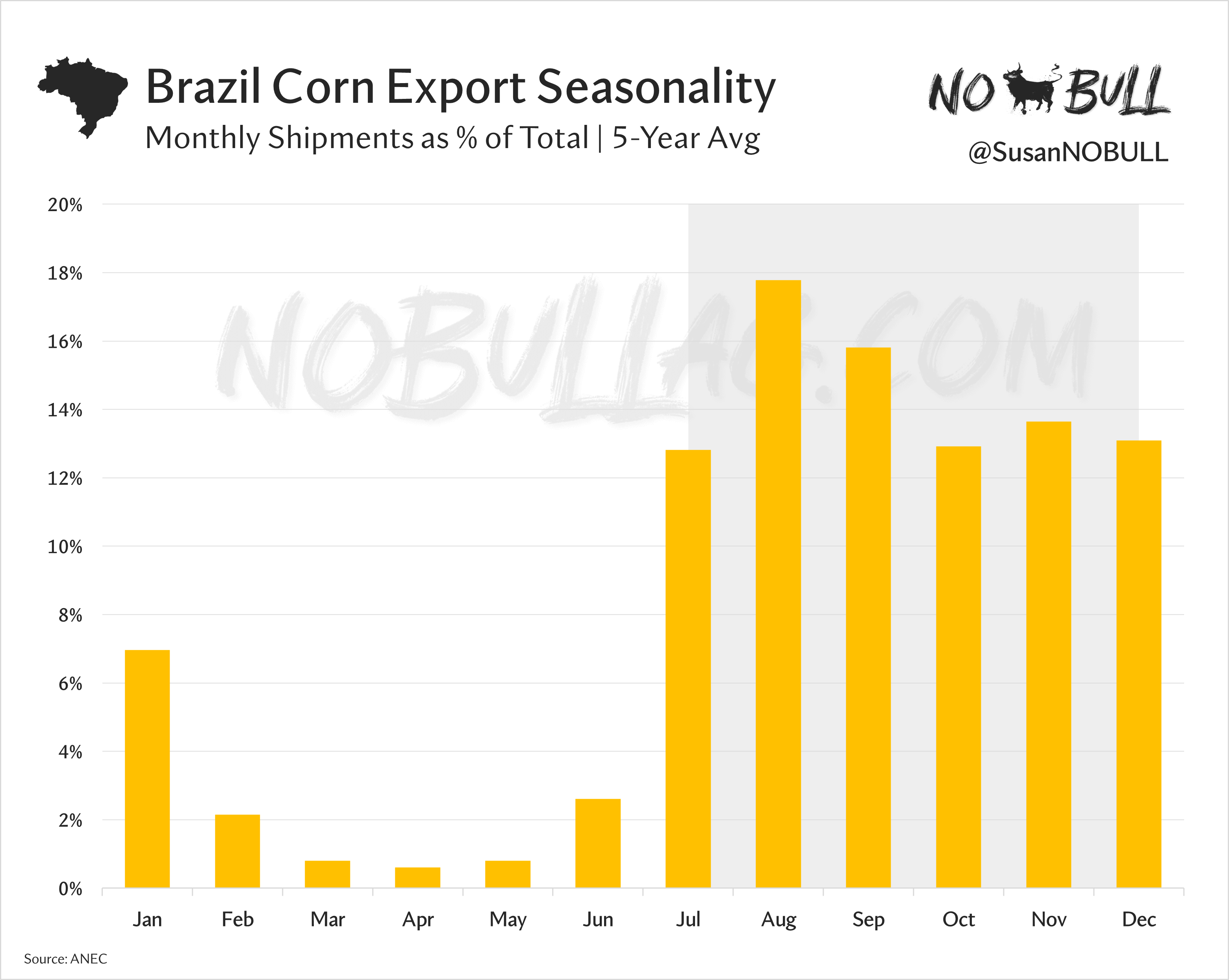

Brazil's August and September exports were down more than 30% year-on-year, which doesn't bode well for the remainder of their 2023/24 program.

August and into the end of the year is normally the prime corn export window for Brazil as 80% of its program is executed during that time.

Recent developments among other leading exporters of the world will leave U.S. corn winning by default for the foreseeable future, until South American new crop hits the market next spring.

For the full version of this post or to subscribe, visit NoBullAg.Substack.com.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.